How To Caculate Total Cost Of Customer Service

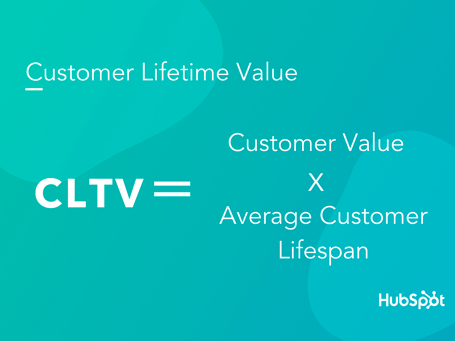

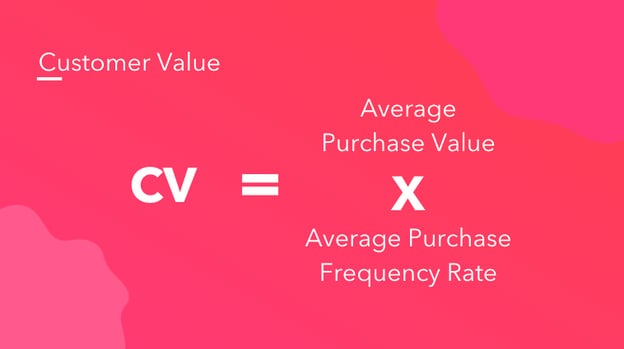

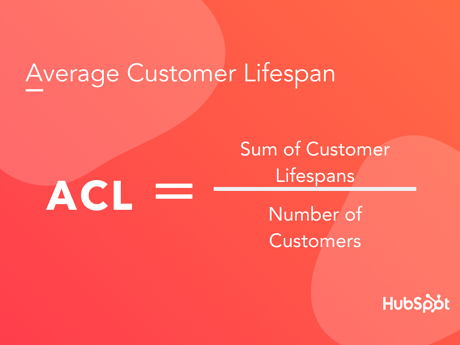

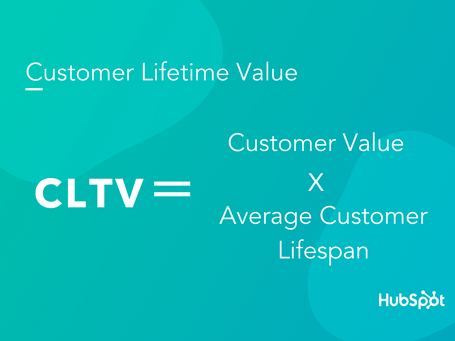

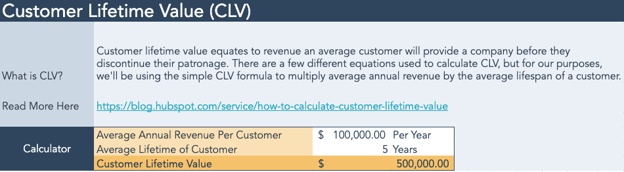

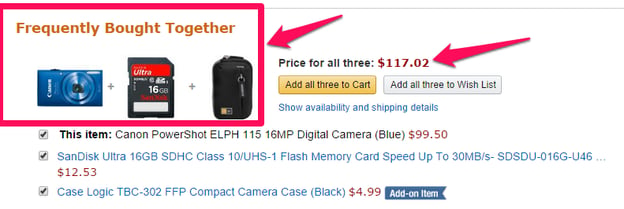

Information technology'south easier to sell to an existing client than it is to acquire a new one. For this reason, you desire to ensure that your customers are satisfied with your product or service and then that you can retain them long enough to compensate the investment required to earn their concern in the first place. The concluding thing y'all desire is for customers to churn then that you continue to scramble for new business. One of the best ways to mitigate this is past measuring customer lifetime value (CLTV). Doing so volition aid your business acquire and retain highly valuable customers, which results in more than acquirement over fourth dimension. Client lifetime value (CLV, or CLTV) is a metric that indicates the total revenue a business can reasonably wait from a unmarried customer account throughout the business relationship. The metric considers a customer's acquirement value and compares that number to the company's predicted client lifespan. The longer a customer continues to purchase from a company, the greater their lifetime value becomes. This metric is something that customer back up and success teams tin directly influence during the customer'due south journey. Client support reps and customer success managers play disquisitional roles in solving issues and offering recommendations that increase customer loyalty and reduce churn. It can besides be used to make business organisation decisions. For instance, y'all can apply customer lifetime value to identify client segments that are nearly valuable to the company and target accordingly. Here are some reasons why agreement your CLV is essential: The longer the lifecycle or the more value a customer brings during that lifecycle, the more revenue a business earns. Therefore, tracking and improving CLV results in more revenue. CLV identifies the specific customers that contribute the most acquirement to your business. This allows you to serve these existing customers with products/services they like and make them happier, resulting in them spending more coin at your company. According to HubSpot Research, 55% of growing companies think it's "very important" to invest in customer service programs. If nosotros look at companies with brackish or decreasing revenue, only 29% said this investment was "very important." Companies that are actively geared towards client success are experiencing more than revenue considering of increased customer satisfaction. If you review CLV every bit a priority in your business organization, yous can identify any worrying trends and come up with activeness items to accost them. For instance, if you find the CLV to be consistently low, y'all can piece of work to optimize your client support strategy or loyalty programme to better meet the needs of your customers. When you know the lifetime value of a customer, you besides know how much money they spend with your business over some time — whether it's $fifty, $500, or $5000. Armed with that cognition, you can develop a customer acquisition strategy that targets customers who will spend the nigh at your business concern. Acquiring new customers can be plush. As noted by a recent article from The European Business Review, acquisition is typically five times more expensive than retention. Additionally, some other written report conducted past Bain & Company found that a 5% increase in retentivity charge per unit can lead to a rise in profit between 25% to 95%. These stats show it's essential that your business organization identifies and nurtures the about valuable customers that interact with your visitor. By doing so, you lot'll have college profit margins, increased customer lifetime values, and reduced customer acquisition costs. At present that we understand the importance of customer lifetime value, permit's dive into lifetime value adding. Customer Lifetime Value = (Customer Value * Average Client Lifespan) To detect CLTV, you need to summate the average buy value and then multiply that number by the average number of purchases to determine customer value. And then, once you lot summate the average client lifespan, you can multiply that by customer value to make up one's mind customer lifetime value. Nosotros'll look at both components of this formula (and how to summate them) below. Client Lifetime Value = (Customer Value * Boilerplate Customer Lifespan) where Client Value = Boilerplate Purchase Value * Average Number of Purchases There are ii models that companies will utilize to measure out customer lifetime value. Choosing between the two can result in different outcomes, awaiting on whether a business is looking at pre-existing information, or trying to determine the future behavior of customers based on electric current circumstances. The predictive CLV model forecasts the ownership beliefs of existing and new customers using regression or machine learning. Using the predictive model for customer lifetime value helps yous ameliorate identify your about valuable customers, the product or service that brings in the most sales, and how you can ameliorate customer retention. The historical model uses past data to predict the value of a customer without because whether the existing customer will continue with the visitor or not. With the historical model, the average gild value is used to make up one's mind the value of your customers. You'll observe this model to be particularly useful if virtually of your customers but interact with your business over a certain menstruation. Even so, because most customer journeys are not identical, this model has certain drawbacks. Active customers (deemed valuable past the historical model) might go inactive and skew your data. In contrast, inactive customers might begin to buy from you lot over again, and y'all might overlook them because they've been labeled "inactive." Read on to learn almost the different metrics needed to calculate customer lifetime value and why they're important. Knowing that there are many different ways to approach lifetime value calculation is useful to businesses in more than ways than one. It helps businesses gauge financial viability and can improve customer retentiveness with a data-driven understanding of what existing customers find valuable from your business. As nosotros examine the most common CLV formulas, clarify the variables that contribute to each to better serve your business needs. Calculate this number past dividing your company's total revenue in a period (usually one year) by the number of purchases throughout that same period. Summate this number by dividing the number of purchases by the number of unique customers who made purchases during that period. Summate this number by multiplying the boilerplate purchase value by the boilerplate purchase frequency rate. Calculate this number by averaging the number of years a customer continues purchasing from your company. Multiply customer value by the average client lifespan. The multiplication will requite you the revenue you lot can reasonably wait an average customer to generate for your company throughout their relationship with you lot. Using data from a Kissmetrics study, we tin have Starbucks as an example for determining CLTV. Its written report measures the weekly purchasing habits of five customers, and so averages their total values together. By following the steps listed above, we tin use this information to summate the average lifetime value of a Starbucks client. First, we need to mensurate average purchase value. According to Kissmetrics, the average Starbucks customer spends nigh $5.xc each visit. We tin calculate this by averaging the money spent past a customer in each visit during the week. For example, if I went to Starbucks three times and spent nine dollars total, my average purchase value would be iii dollars. Once we calculate the average purchase value for one customer, we can repeat the process for the other v. Afterward that, add each boilerplate together, split that value by the number of customers surveyed (5) to get the average purchase value. The side by side step to computing CLTV is to measure the average buy frequency charge per unit. In the case of Starbucks, we need to know how many visits the average customer makes to i of its locations within a week. The average observed across the five customers in the report was found to exist 4.ii visits. This makes our average buy frequency charge per unit 4.2. At present that we know what the boilerplate customer spends and how many times they visit in a week, nosotros can decide their customer value. To exercise this, we accept to look at all 5 customers individually so multiply their average purchase value by their average buy frequency rate. This lets the states know how much revenue the client is worth to Starbucks within a week. Once we repeat this calculation for all five customers, we average their values to get the average customer's value of $24.30. While it's non explicitly stated how Kissmetrics measured Starbucks' average customer lifetime span, it does list this value as 20 years. If nosotros were to calculate Starbucks' average customer lifespan, we would take to look at the number of years each client frequented Starbucks. Then we could average the values together to get twenty years. If yous don't have 20 years to expect and verify that, ane fashion to estimate customer lifespan is to divide 1 by your churn charge per unit per centum. One time nosotros take adamant the average customer value and the average customer lifespan, we can utilize this data to calculate CLTV. In this case, we first need to multiply the average client value by 52. Since we measured customers on their weekly habits, we need to multiply their client value past 52 to reverberate an annual average. Later on that, multiply this number by the client lifespan value (20) to go CLTV. For Starbucks customers, that value turns out to be $25,272 (52 x 24.30 x twenty= 25,272). Now that you know your customer lifetime value, how do you increase information technology? Here are some strategies that can help. Customer onboarding is the process of bringing your customers up to speed with your brand — what you practice, why it matters, and why they should stick around. Onboarding happens in the start few days after customers make their commencement purchase. When they caput back to your website to wait at other items or connect with you via email, they're learning how your company works and what you can offer. The result? Yous need to stand out while making this straightforward. Utilise the data customers have provided to offer curated particular selections or keen deals, and then follow upward with email contacts to make sure what they've already bought lives upwardly to expectations. Optimized onboarding processes work because they establish a framework for long-term customer relationships that help increase CLV over fourth dimension. One of the smartest ways to ameliorate your CLV is to increase your average order value. When a customer is about to check out, you tin can offer relevant complementary products to those they're about to buy. Brands like Amazon and McDonald's are examples of companies that use the upsell and cantankerous-sell method extremely well. Amazon will offer yous related products and bundle them into a group cost every bit depicted below. Prototype Source McDonald'southward, meanwhile, offers pocket-size add together-ons — such equally those delicious apple pies — that assistance boost overall CLV. If you're a subscription-based company, you tin can increment your average order and customer lifetime value by encouraging your customers to switch to an annual billing wheel. This works considering even a modest increment in order value over fourth dimension leads to increased CLV and overall revenue. Consider the example of the McDonald's apple pie. While adding a $1(ish) item to each transaction isn't much on its own, over time these smaller amounts add together up to substantive revenue and help increment total CLV. Long-term customer relationships are based on trust. If buyers believe that your company offers them the all-time prices on the products and services they desire, they'll come back. Simply this is only the outset. With social media now a critical part of any branding and marketing efforts, customers want more than than just a business-based relationship — they want to cultivate a personal connection that makes them feel like more simply a route to ameliorate business ROI. Every bit a event, information technology's critical to engage with customers on your social media accounts with more than just canned advertising posts. For example, your teams could start a back-and-forth conversation almost something that interests your target client base, or you could do some social sleuthing to detect more almost your customers and then send them a (pocket-sized) free gift that aligns with their interests. This works because you need to stand out from the crowd. Quick and easy eCommerce is now par for the class — if yous can forge an bodily connection with customers you'll proceed them coming back and increase your total CLV. Sometimes it's amend to listen than talk. Customers often have skilful communication on how you could better business practices to better serve their needs — and you can increase CLV by taking it. For example, you could create a poll on new product or service ideas and see what your customer base thinks. Make sure y'all don't lock them into a specific set of choices; give them room to add their ain ideas that could help make things better. While not every customer volition participate, those that practice will ofttimes have good advice and can end up existence some of your nearly loyal customers. Quick tip: Requite credit where credit is due. If a customer comes up with a good idea, credit them for the assist and consider sending them something as a token of appreciation. This works because information technology shows you're willing to mind. Besides many brands take the stance that they know what their customers want better than customers themselves, which in turn can lower total CLV. Past taking the time to listen and respond — fifty-fifty if customer communication isn't exactly what you lot want to hear — you tin facilitate long-term loyalty and boost CLV. Customers won't wait around for your make to connect with them or answer their questions. Recent survey data found that 88% of customers want a response to emails in one hour or less. While this isn't always possible, businesses tin put practices in place to shorten response times and empower easy connections. Active social media is ane instance. By equipping a customer success team with the tools and technology to monitor and reply to customer comments or concerns via social media, brands can jumpstart the connection procedure and assist customers feel heard. CLV is at present driven by relationships and relationships require an ongoing connection. While ane-hr email response times may be out of reach, the easier you lot make it for customers to connect with your make the more connected they'll experience overall and the more than probable they'll come back to spend more money. xc% of Americans say that customer service is one factor they consider when choosing companies to do business with. And then if you want to amend your customer lifetime value, you lot should pay attending to your customer service and look for means to go far excellent. You lot tin can improve your customer service by offering existing customers personalized services, omnichannel client support, and a proper return or refund policy. It'southward uncomplicated: The better your customer service the more customers feel valued by your brand for more than their purchases. If you stand behind your products with substantive render and refund policies, it communicates to customers that your priority is quality and satisfaction, non overall sales volume. The result? Increased CLV. Customer lifetime value is an incredibly useful metric. Information technology tells you lot which customers spend the most at your business and which ones will remain loyal to yous for the longest amount of time. Use the formulas and model provided to a higher place and kickoff calculating CLTV for your business today. Editor'south notation: This post was originally published in May 2021 and has been updated for comprehensiveness. ![→ Download Now: Customer Service Metrics Calculator [Free Tool]](https://no-cache.hubspot.com/cta/default/53/e24dc302-9dc2-466f-a5ca-ab4e08633c0f.png)

What is Customer Lifetime Value (CLV)?

Why is Client Lifetime Value Important?

ane. Increasing CLV can increase revenue over time.

2. It can help you identify bug so you lot can boost customer loyalty and retentivity.

3. It helps yous target your platonic customers.

4. Increasing CLV can assistance reduce customer conquering costs.

How to Calculate Customer LTV

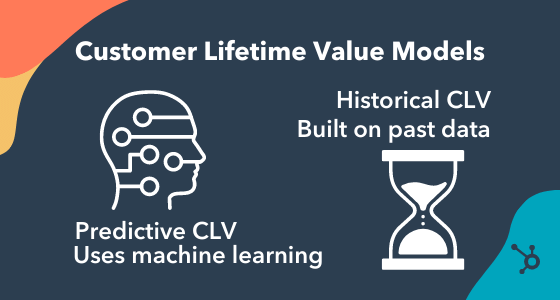

Customer Lifetime Value Model

Predictive Customer Lifetime Value

Historical Client Lifetime Value

Customer Lifetime Value Formulas

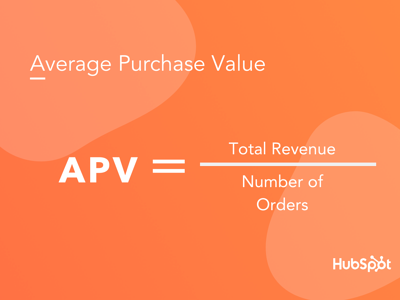

Average Purchase Value

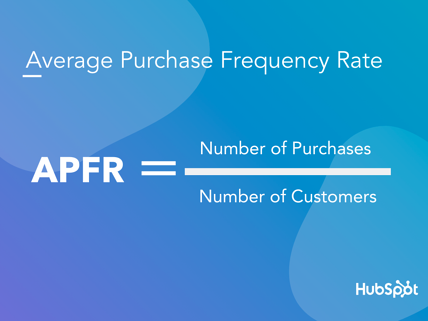

Average Purchase Frequency Rate

Client Value

Average Customer Lifespan

Client Lifetime Value Formula

Customer Lifetime Value Example

Follow Along with HubSpot'due south CLV Computer Template

Download Now

Download Now1. Calculate the average purchase value.

2. Calculate the average purchase frequency rate.

3. Calculate the average client'southward value.

4. Calculate the boilerplate customer'southward lifetime bridge.

5. Calculate your customer's lifetime value.

How to Increase Customer Lifetime Value

1. Optimize your onboarding procedure.

Why This Works

ii. Increment your average order value.

Why This Works

3. Build long-lasting relationships.

Why This Works

4. Embrace good communication.

Why This Works

5. Empower easy connections.

Why This Works

six. Improve your client service.

Why This Works

The Benefit of Customer Lifetime Value

How To Caculate Total Cost Of Customer Service,

Source: https://blog.hubspot.com/service/how-to-calculate-customer-lifetime-value

Posted by: norristimentep.blogspot.com

0 Response to "How To Caculate Total Cost Of Customer Service"

Post a Comment